|

Getting your Trinity Audio player ready...

|

Trouble Finding Areas With High Occupancy Rates?

Imagine you’ve just bought a 3-bedroom property in a good location. The next step is to put it on the market and start turning a profit. If only it was that easy!

Location and number of bedrooms are not the only important factors when buying a property. As an investor, you always have to take the property’s earning potential into consideration.

The first thing you’d want to check is the area’s occupancy rates. This refers to the number of rental units occupied vs. the total number of available rental units.

Getting the occupancy rates also means taking a deep dive into economic factors such as restaurants & pubs, town centres, and job growth. You’ll also have to consider social factors like available schools & hospitals, community areas, and even crime rates.

And this is just the tip of the iceberg. There’s still more!

What Else To Search For Other Than High Occupancy Rates?

Great Transport Links

Transportation plays a great role in every person’s life, especially for young professionals and growing families.

It would be awesome to find a town with great links to major cities like Liverpool and Manchester. It increases the value of the property and also drives demand for rental properties in that town.

Tenant Demand

Tenant or rental demand shows the competitive need for properties in a specific real estate market. This represents the number of people looking for rental properties, and it’s a key indicator of income potential.

In the UK, tenant demand in city centres is rising again as lockdown restrictions start to ease and offices are reopening.

Too Much Work? We'll Do The Heavy

Lifting For You!

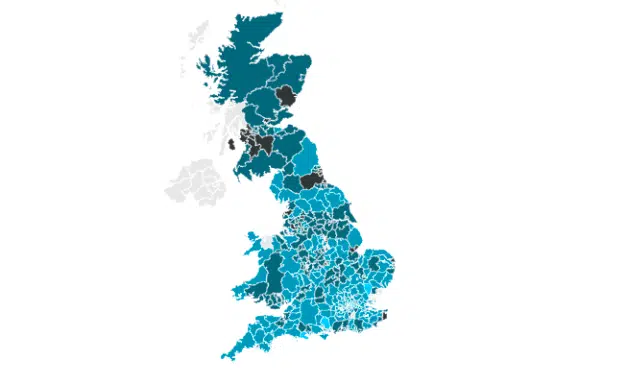

You don’t have to do all the research by yourself. Let’s make things easy and simple with our Property Heatmaps!

PDI’s heatmaps allow you to take a peek and learn more about:

With all these factors right on your screen, it’s easier to analyse and decide which property to go for as the perfect investment. So, skip the long process and take a shortcut with Property Deals Insight.

Looking For High Yield Properties?

Go to your dashboard to find high yield buy-to-let deals in your target area. Or sign up to claim free access if you aren’t a member yet.

If you have any questions or feedback please reach out to us via email – info@propertydealsinsight.com or give us a call at 02033898222.