Main Menu

When you want to generate profit fast – and get your investment out ready for the next deal, the Buy, Refurbish, Refinance (or resell) (BRR) strategy is an excellent way to do it.

You can use this strategy alongside other property strategies. It can be used whether you’re buying to let or buying to sell.

It depends on your ability to increase the value of the property by refurbishment. Usually, this is replacing the kitchen and/or bathroom(s) and decorating throughout. When you’ve increased the value, it’s time to remortgage the property based on its new value.

By increasing the value, you will release your initial deposit (or, at least, some of it) so you can start the process again with another below market value (BMV) property.

The digital age has made data extremely accessible so records of the property’s history can be accessed. As you will need to prove to the mortgage company and their surveyor that the added property value is genuine, you’ll have to show how the value has increased by comparisons with other similar properties in the location.

This strategy relies on you adding significant value with the execution of the refurbishment and providing detailed information on every aspect of the refurb, including before, during and after photos. This will show the lender’s surveyor that the property has had real value added to it. Once the surveyor has confirmed the new value for the property you can refinance at the new price.

The concept of this strategy means that you can increase your Return On Investment (ROI) dramatically. As a buy-to-let, you’ll earn on rental income and equity. If you sell the property on, instead of remortgaging, you’ll make a healthy profit.

This strategy is based on risk and reward. The impact is amplified as you refurb and add value to multiple properties. The reward increases as more properties bring in more rental income (or more sale profits) and provide you with the potential to increase the value of capital growth.

The risk factor

With this strategy, you’ll need a contingency budget. This will cover situations such as:

The refurb and remortgage process can take between 6-9 months. The timeframe may vary depending on the property, how efficient your refurb team work and the speed of the lender’s remortgage process. It is now a standard requirement that a property must be registered with the owner for a minimum of 6 months at the land registry before applying for a re-mortgage.

Bridging/Cash Deals

For most investors, 6-9 months is a good enough timeframe but the more experienced Investors can look at buying the property for cash or use Bridging Loans to get around this limitation of having to wait for that long to remortgage. That allows them to release all or part of their initial investment much quicker and allows the investor to move to the next deal. Thereby allowing them to recycle their initial cash pot and helping build a property portfolio.

Knowing the market is very important as the property market may suddenly dip, which means that, to make a good profit you’ll need to find some really great BMV deals.

So the question now is… how do you find these hidden gems? Finding the perfect property for employing the BRR Strategy can be challenging due to.

This is where Property Deals Insight comes in. Our Deal Finder provides you with an in-depth look at all the Buy Refurb Refinance properties in an area of your choice. Hundreds of our clients have already uncovered countless heavily discounted properties and you can join them using our simple yet powerful tools. Analyse any deal instantly and protect yourself from unwise investments.

With Property Deal Insight’s Deal Finder offering, you will find your perfect buy refurb refinance property in the UK to have high returns on your investment. Our platform enables you to find interesting BRRR deals in a region of your choice.

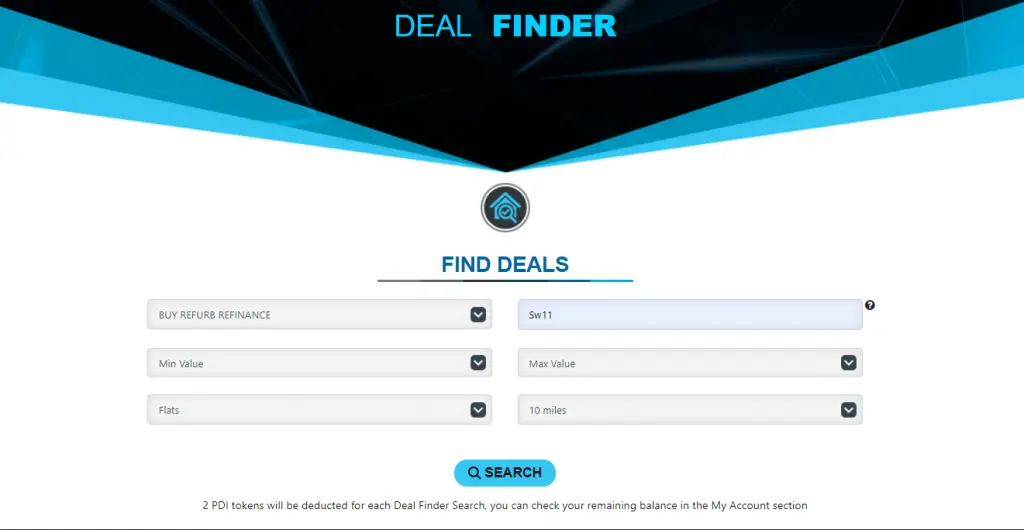

On the ‘’Deal Finder’’ page select ‘’Buy Refurb Refinance’’

Here you can search any property for a potential refurb in any location (we’re using London SW11 to demonstrate) Additionally you can choose a property type (house, flat or land), set your search radius (we’re limiting the search to 10 miles)

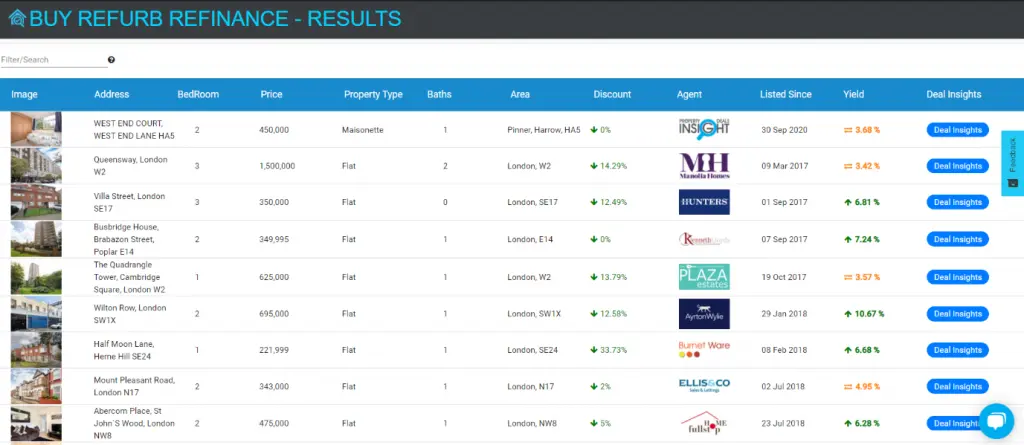

Upon searching, you’ll be met with a list of results that fit your search criteria. This will let you browse through multiple properties. Additionally, there is an overview of the properties’ guide prices, an estimate of their profitability and a number of property-specific details. (Bedrooms, their specific location, listing date, etc.)

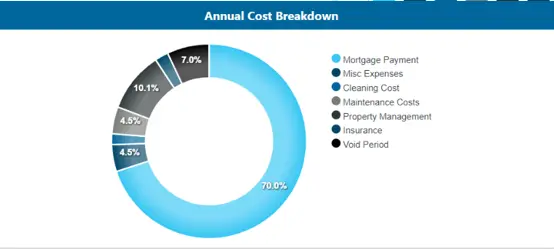

Upon clicking on the listing, you’ll see a collection of useful figures and graphs relating to the property including the guide price, estimated monthly fees, maintenance costs and your expected yearly cash flow. With this information, you can gain a clear understanding of whether a property is worth your time and money investment.

Our tools even display the amount of cash left in the deal, year on year, based on your final offer and how long it will take to get all or part of your money back. Our professional graphics make it easier for you to analyse the numbers and to see if the property in question fits your expectations.

So if the Deal Insights doesn’t look great, simply move on to select another property that suits you. This can be within criteria you initially search at the start or go back to the deal finder where you can reselect a different type of criteria, where you can explore different regions of the UK.