Main Menu

They’re thrilling, lucrative and—at times—risky. For property buyers with enough market savvy and know-how, auction properties can offer fantastic ‘fixer-upper’ projects: bought cheap, polished up and sold for a profit (or else rented out). You can make a mighty profit on them, but beware, auction properties can be an absolute money-sink for reckless, uninformed or unprepared buyers. Proper research and planning are key to achieving a successful property acquisition and seeing a strong return on investment. We know that thorough research is easier said than done, but don’t worry, with Property Deals Insight, you’ll have all the tools you need to browse, bid and buy with confidence.

Homeowners often choose to sell via auction when they need a quick, guaranteed property sale. Even free of disruption, operating within the open market is time-consuming and the ever-present threat of a sale falling through is a gamble some homeowners can’t afford to take.

Additionally, properties that don’t stand to perform well on the open market (due to their poor condition or unusual features) are frequently sold at auction. There, unappealing properties are typically bought by property developers, renovated and sold (or rented out) once they’re desirable.

Finally, auctions can be a good place to buy repossessed properties from mortgage lenders. These properties are often particularly cheap, not because of their flaws, but because lenders don’t have time to put in the effort and get the most out of a sale.

Most of all, buying at auction can be a great way to snap up a bargain. With a smart investment, a good eye for value-boosting renovations and a little elbow grease, auction properties can earn you a sizable sum or be a strong long-term revenue stream.

On top of this, the auction process is also refreshingly quick. After the winning bid is placed, the sale must be finalised and in the ownership of the bidder within 28 days. No unexpected waiting and zero risk of the sale falling through.

Auction sales are transparent too, with every property’s relevant legal documentation readily available well in advance of the big day. With auction properties, you know what you’re getting.

So, a property is in your sights and you want nothing standing in your way come auction day. What can you do? Prior to the auction, there are a number of details to research and arrangements to make in order to ensure a smooth and surprise-free auction. And with Property Deals Insight, you’ll gain an immediate edge over the competition.

First, it’s a good idea to research your chosen property’s surrounding area. What are similar nearby houses listed for? What are the local rental trends? Our Property Insight Reports can give you valuable information regarding the value, profitability and overall prospects of similar properties in the local area which will help inform crucial decisions concerning your chosen property.

Second, it’s vital that you acquire the property’s legal pack; it should be freely available online. This will contain all the property’s relevant legal documentation including planning permission agreements, lease information and special conditions of sale. It’s advisable to get your solicitor to read this, as it will contain vital information regarding any additional costs, necessary renovations or unwanted complications concerning the sale itself, which will, in turn, determine your maximum bid.

Third, as mentioned, it’s wise to settle on a maximum bid in advance of the auction. Our Property Insight Reports can help you here too: the Cash Flow and Flip Analysis tools show, in detail, how any investment is likely to pay off (or not) should you choose to refurbish and sell a property or else rent it out.

Finally, you should sort out financing in advance of the property sale. On the day of the auction, you’ll pay a 10% deposit on the property’s guide price; upon winning the auction you’ll have 28 days to pay the remaining sum. Securing a mortgage agreement in principle (AIP) beforehand with your bank will prevent those 28 days from becoming a frantic scramble for a willing mortgage provider. Some buyers, if they’re waiting on funds from a separate property sale, will benefit from short-term bridging loans to ‘buy time’ beyond those 28 days.

Unfortunately, one of the major risks of buying at auction is also one of the major appeals: the excitement of it all. In a tense bidding war, it’s easy to get carried away, lose sight of your predetermined maximum bid and pay far more than you bargained for. The last thing you want is to be stuck with a property that costs too much to ever be profitable.

For this reason, it’s crucial that you know the ins and outs of any property you’re looking to bid on. Knowing the potential for return on investment is crucial for determining where to draw the line and accept defeat in a bid (or else push just that bit further and bag the property). That’s where Property Deals Insight comes in! Our powerful tools can help you locate lucrative properties and draw up a game plan for the day of the auction.

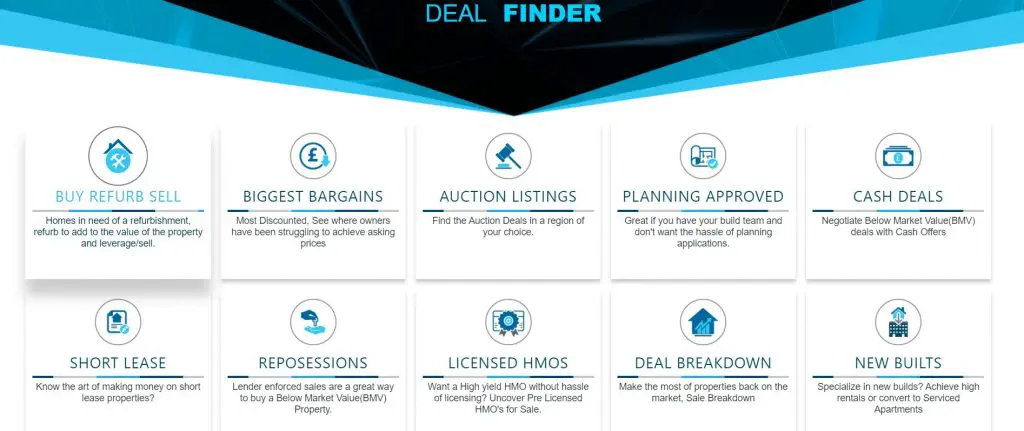

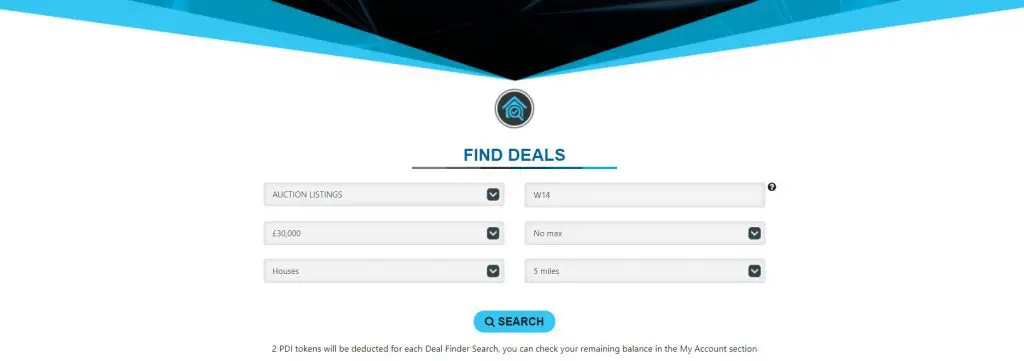

On the “Deal Finder” page, select “Auction Listings”.

Here, you can search for any auction listing in any location (we’re using London, W14 to demonstrate). Additionally, you can choose a property type (house, flat or land), set your price range and determine a search radius (we’re limiting the search to 5 miles).

Upon searching, you’ll be met with a list of results that fit your search criteria. This will let you browse through multiple properties. Included in this overview are the properties’ guide prices, an estimate of their profitability and a number of property-specific details. (Bedrooms, their specific location, listing date, etc.) Let’s look at the fourth entry on the list.

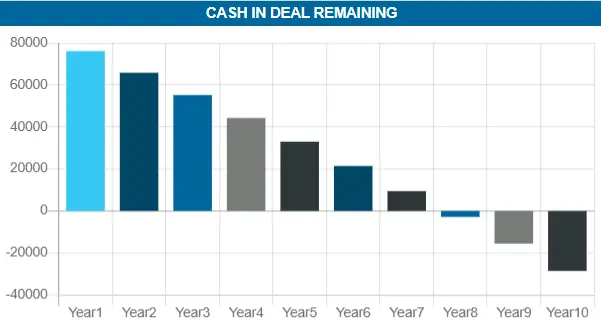

Upon clicking on the listing, you’ll see a collection of useful figures and graphs relating to the property including the guide price, estimated monthly fees, maintenance costs and your expected yearly cash flow. With this information, you can gain a clear understanding of whether a property is worth your time and money investment.

Our tools even display the amount of cash left in the deal, year on year, based on your final offer. In an auction situation, this is invaluable as it lets you make on-the-fly decisions during tense bidding situations. Unsure whether to throw in one more bid? With our tools, you’ll know whether an offer is worth making or not.

Empowering you to make smart property decisions faster

Start for Free