|

Getting your Trinity Audio player ready...

|

There’s never been a better time to invest in buy-to-let property. Low-interest rates and intense competition for rental properties, as more people are moving out of London in search of more space and lower payments.

According to Zoopla, the stock of homes is down by a third (33.2%) compared to this time last year.

So it has become even more important for investors to target the right areas based on their specific investment needs.

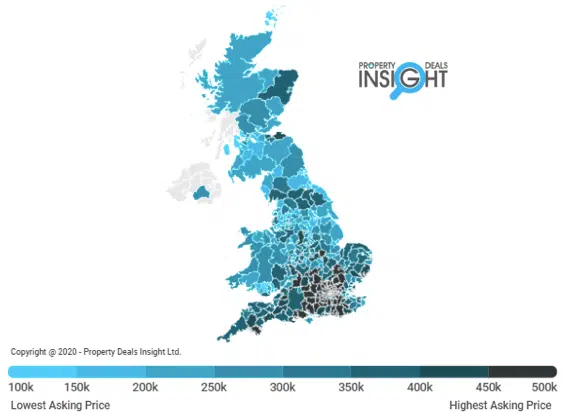

Using our Property Heat Maps, we have compiled the hottest buy-to-let areas for high occupancy rates, rental yield, and capital growth.

Bristol: Highest Occupancy Rate

Bristol has been the best city for rental demand, with only 0.6% of the housing stock left vacant on average last year.

It also has a large proportion of renters with more than a quarter of Bristol’s residents estimated to be privately renting, creating a large pool of tenants for buy-to-let landlords to pick from.

Liverpool: Most Capital Growth

Liverpool registered the highest capital rate of growth of any of the UK’s larger cities this year at 10.7%.

And it’s estimated that the North West region will see house prices rise by 24% through to 2024, outpacing the rest of the UK.

Also, because of Liverpool’s 3 large universities, every year there are more than 58,000 students and 30,000 graduates all looking for a home in this exciting and vibrant city.

Top 3 Highest Yield Areas

Most investors in search of high yields usually target popular areas such as Manchester and Bristol which both have an average yield of above 5%.

But if you are looking for double-digit yields you will have to invest in markets that are a lot less saturated.

Here is our list of the top 5 areas for yield in the UK:

1. East Ayrshire 26%

2. Lichfield 15%

3. Eastbourne 13%

4. Braintree 13%

5. Hartlepool 12%

Don’t forget to keep an eye on local occupancy rates and government regulations before you invest in any buy-to-let market.

The Latest Data at Your Fingertips

Zoopla reported that rents were rising at the fastest pace for 13 years. But the recent soaring house prices have also made it harder to find good deals. With Property Heatmaps you’ll be able to focus in on the areas that fit your investment criteria and find the best deals on the market.

PDI’s heatmaps allow you to take a peek and learn more about:

With all these factors right on your screen, it’s easier to analyse and decide which property to go for as the perfect investment. So save yourself hours of research and take a shortcut with Property Deals Insight.

Go to your dashboard to find the best buy-to-let deals in your target area.

Or sign up to claim free access if you aren’t a member yet.

If you have any questions or feedback please reach out to us via email – info@propertydealsinsight.com or give us a call at 02033898222.