Main Menu

|

Getting your Trinity Audio player ready...

|

Property Investment for beginners can be exciting but daunting. There are many different ways of investing in property, some with more risk than others. However, if you research properly and make wise decisions, the rewards can be very promising. This blog will help you understand how to invest in property and some of the key considerations.

Property investment is an excellent way of generating revenue and can be done by both beginners and experts. Five of the main reasons people invest in property include:

Research is key to property investment, especially as a beginner. While these benefits of property investment are very attractive, there are risks involved. You must carefully consider the type of property you want to invest in and its opportunities for profit, the location of the property, and how you will finance the investment. Check out our recent blog breaking down some of the changes to the property investment market post lockdown.

There are different ways you can invest in property and some will come with higher risk than others. It is important to consider your goals and how you plan on making a return on investment. Here are some of the most common ways to invest in property:

Buy-to-Let

Investing in a buy-to-let property is one of the most popular options. It is also relatively low-risk so long as the property is in a desirable location. Buy-to-let gives you the opportunity to generate a regular income through tenants paying rent. Additionally, you can then aim to make a profit on the property when you sell it as house prices often increase in value.

House Flipping

House flipping involves investing in a low-cost property that needs renovation work or major improvements. Once renovation work is complete, the aim is to sell the property for a considerable profit.

The concept is higher risk than buy-to-let. However, it is a great way to enter the property market. The key with house flipping is having realistic budgets which are under control. It is also helpful if you can keep costs down by carrying out much of the DIY work yourself.

Commercial Property

Commercial properties include retail buildings, office blocks, warehouses and other non-domestic buildings. You will often require a higher investment for commercial properties and there is risk involved. However, there is also more opportunity for financial reward.

There are different ways to finance property investment. These include buy-to-let mortgages, commercial mortgages, bridging loans, and auction finance. The option most suitable for you will depend on the property you are investing in, its value, how you plan to make a return on investment, and what your financial circumstances are like. It is wise to speak to a financial advisor to understand what is most viable for you.

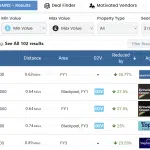

To research the property investment market, use our Property Deal Finder. These will help you to find great deals, check out comparative values, accurate rental prices and yield. For more property investment tips visit our page below.