|

Getting your Trinity Audio player ready...

|

When looking for property investment opportunities in the UK, there are many important factors to consider. And it is important to feel certain before making any decisions, given the size of financial investment required. In this blog we explain rental yield, one of the more important factors to consider when looking at buy to let properties, as well as provide current data on which London Boroughs perform the best and worst for this metric. Whether you are an experienced property investor, or just someone who was lucky enough to stumble across this page, we have no doubt that you will learn something useful.

What is rental yield?

Rental yield is a measure used to quantify the value of the returns you can expect to receive from a property and is a good indicator of whether a buy to let investment makes financial sense. The math behind rental yield is very simple, but vital when considering different investment strategies. It is calculated as follows:

Rental Yield Across All London Boroughs

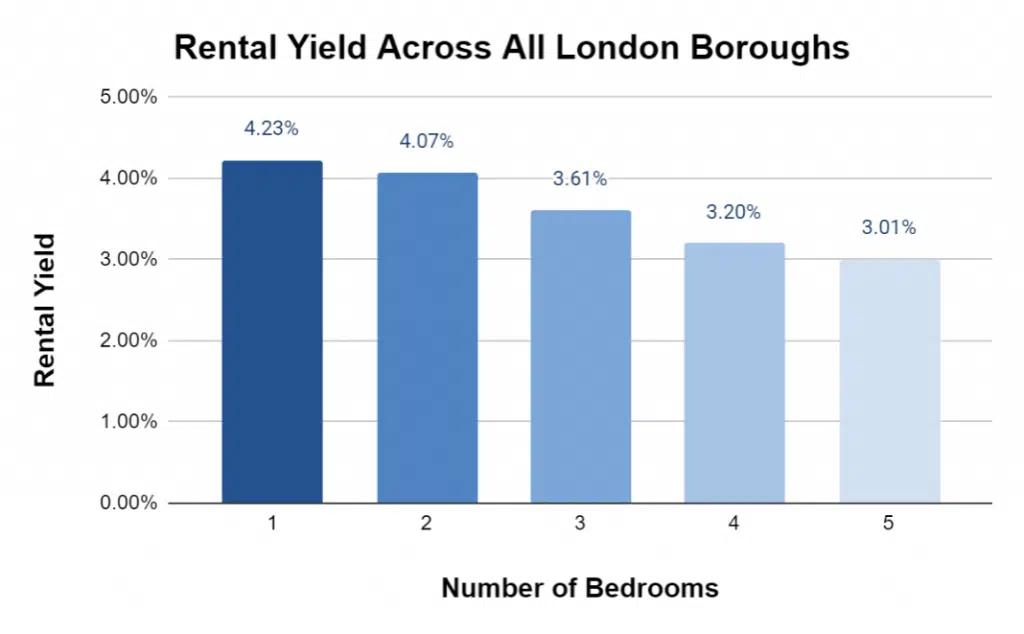

Property Deals Insights have collated rental yield data from all 32 London Boroughs for different sized properties to give you an idea of what areas you may, or may not, want to look at when thinking about a buy to let investment. The average rental yield across all properties is 3.62% in London, which is between the national average of 3 – 5%. Slightly lower yields are more common in metropolitan areas, particularly capital cities, as annual expenses and purchase prices are generally higher. The bar chart above shows that as property size increases, from 1 to 5 bedrooms, the rental yield across London decreases from 4.23% to 3.01%. There are likely multiple reasons for this, for example, there could be a higher demand for smaller properties linked to the continued influx of international students into the UK and London. These tenants are usually looking for one or two-bed studios and, more often than not, have the financial capacity to afford higher rents. This is also the case for young professionals who are looking for a move to a city rife with opportunities.

Top 5 London Boroughs for Rental Yield

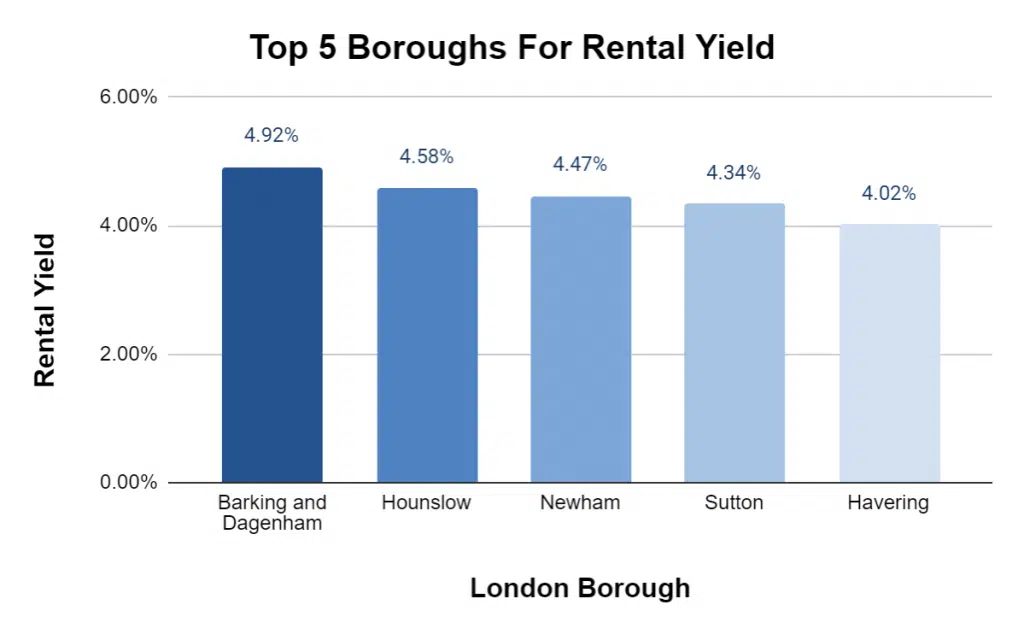

Our property insights data shows that East London is a promising area to consider if looking for a buy to let property in the Capital. In Barking and Dagenham, Newham, and Havering, the current rental yields sit at 4.92%, 4.47%, and 4.02%, respectively. The southwestern boroughs of Hounslow and Sutton are also promising locations for prospective property investment.

Lowest 5 London Boroughs for Rental Yield

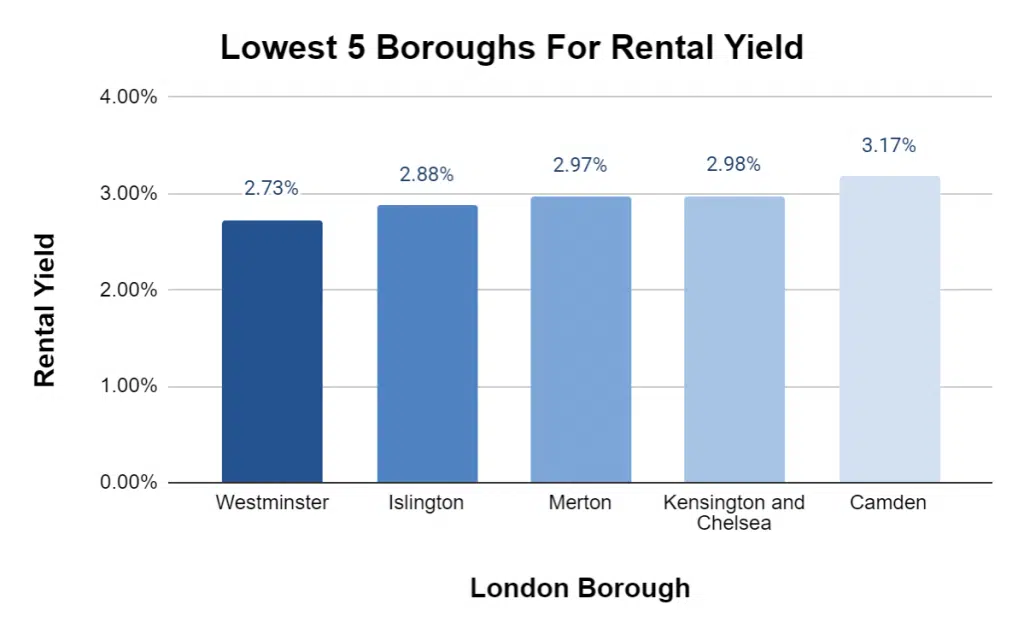

Boroughs around the city centre show the lowest rental yield, with Islington, Camden, and Westminster being directly adjacent to the City of London, and Kensington and Chelsea situated slightly further out. This is expected as the costs of owning a property generally tend to increase as you move into central London. Merton, located in the southwest, is another area you may want to avoid when considering buy to let investment. Interestingly, this borough is adjacent to Sutton which appears in the top five. This could be down to many reasons and just shows that you don’t have to travel far to see high contrasts in rental yield.

Of course, rental yield is not the only consideration when looking to invest in a buy to let property. Capital growth, or the appreciation value of a property, is also very important. This is because, you will need to consider an exit strategy as you may plan to sell on at some point in the future. As well as this, ongoing and future developments to local infrastructure should also influence your investment strategy. For example, the continuing development underway at Wembley Park is one of the biggest regeneration projects Europe has ever seen. From new homes to outdoor spaces, and commercial initiatives to provide job opportunities, this could all result in the rental yield across the borough of Brent increasing from its current 3.65 % over the next few years. Obviously, your own financial constraints will also impact where you look to invest. If you want information on house price trends going back 10 years, check out our recent blog.

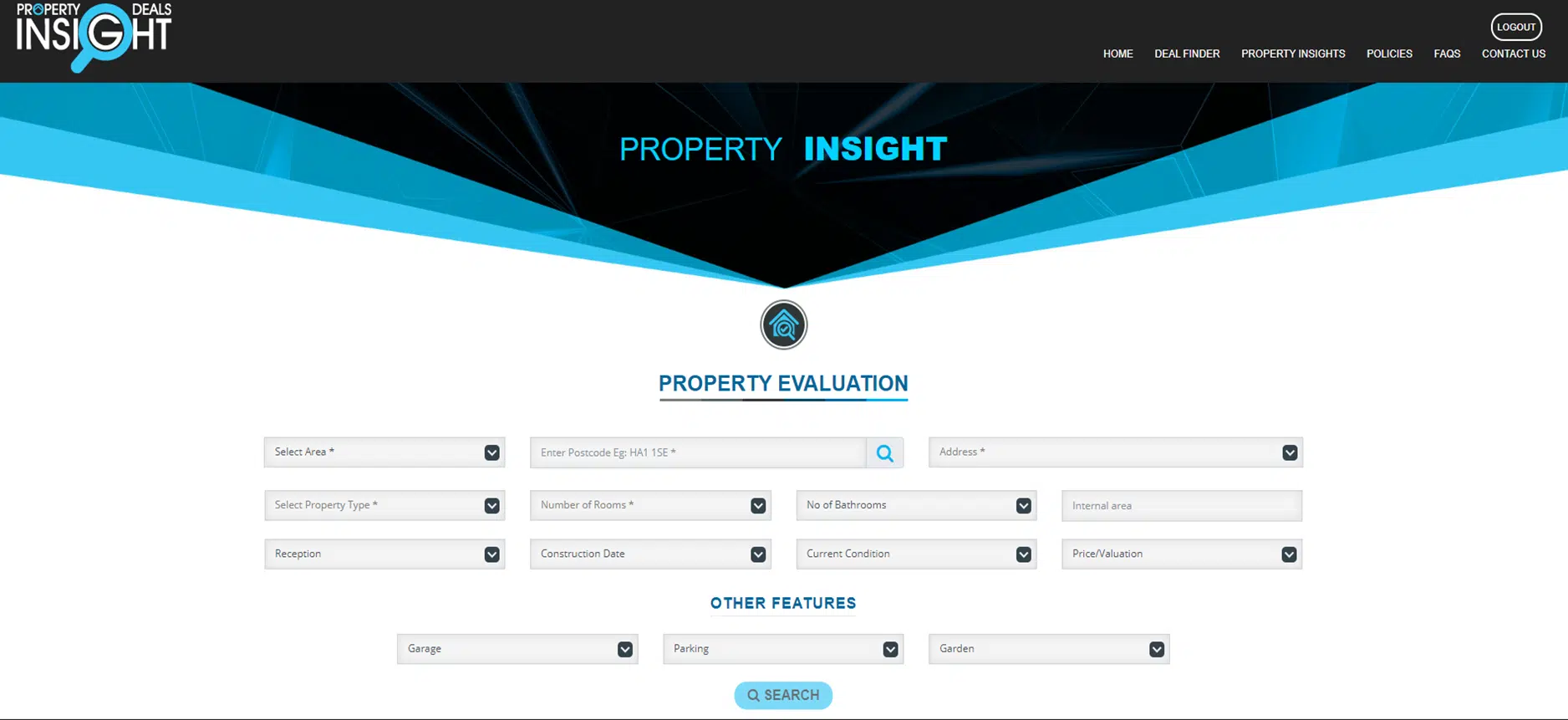

To carry out your own analysis using our property insights data, including rental yields across the UK, sign up for a free trial. Alternatively, feel free to contact us if you have any further questions.

2 Comments

Comments are closed.