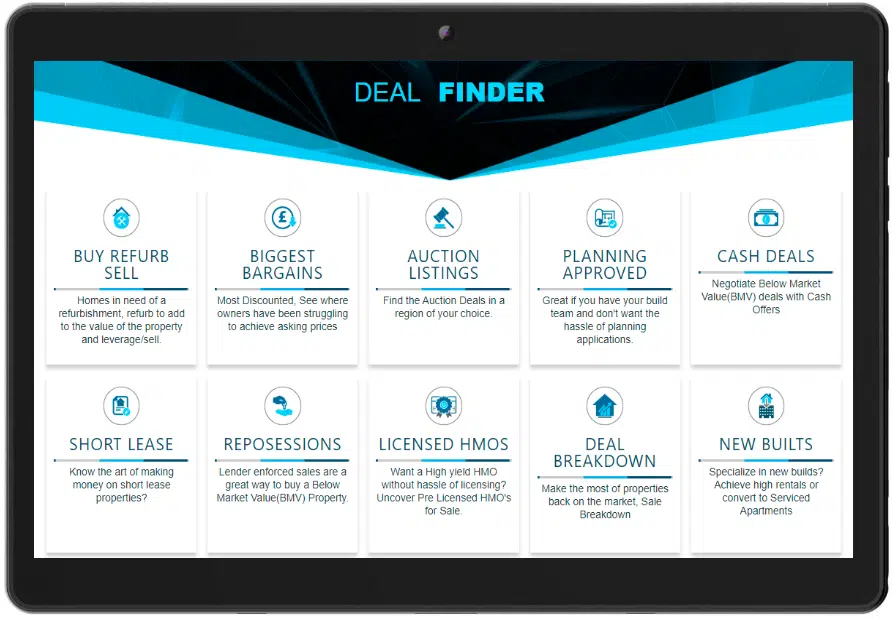

Main Menu

The short term lease property strategy involves looking for properties that have a relatively short time left on the lease. These properties are typically ignored by the everyday buyer and hence can be bought at bargain prices. Eventually, a property owner can apply for an extension of the lease, which, in conjunction with any renovation work also undertaken within those two years, will drastically increase the property’s value.

Smart property investors, particularly those with enough patience, stand to earn serious amounts of profit from the short lease investment strategy.

Flats—whether purpose-built blocks, converted houses or above shops—are usually sold on leaseholds. This essentially means that ownership is bought for a fixed period of time, commonly either 125 years or 99 years, although new developments are typically sold for much longer leaseholds of 999 years. The freeholder retains ownership of the land on which the property is built upon so, essentially, it’s a long term rental contract.

Any flat can be bought or sold as long as the leasehold is valid, but as time goes by, banks and building societies become increasingly wary about approving mortgages for them. This makes the property an unsightly investment, scaring casual home buyers off and causing a sharp decline in the property’s value.

As mentioned, leases aren’t set in stone; they can be extended by the owner, either after renting it out and owning the short term rental for 2 years, or by having the outgoing seller apply for it on the owner’s behalf. It’s a hassle, but it can be done and the cost of extending the lease is still a fraction of the value that the property will gain.

So the question now is… how do you find these treasure chests? Finding short lease properties in the UK can be challenging due to.

This is where Property Deals Insight comes in. Our Deal Finder provides you with an in-depth look at all the Short Term Lease properties in an area of your choice. Hundreds of our clients have already uncovered countless heavily discounted properties and you can join them using our simple yet powerful tools. Analyse any deal instantly and protect yourself from unwise investments.

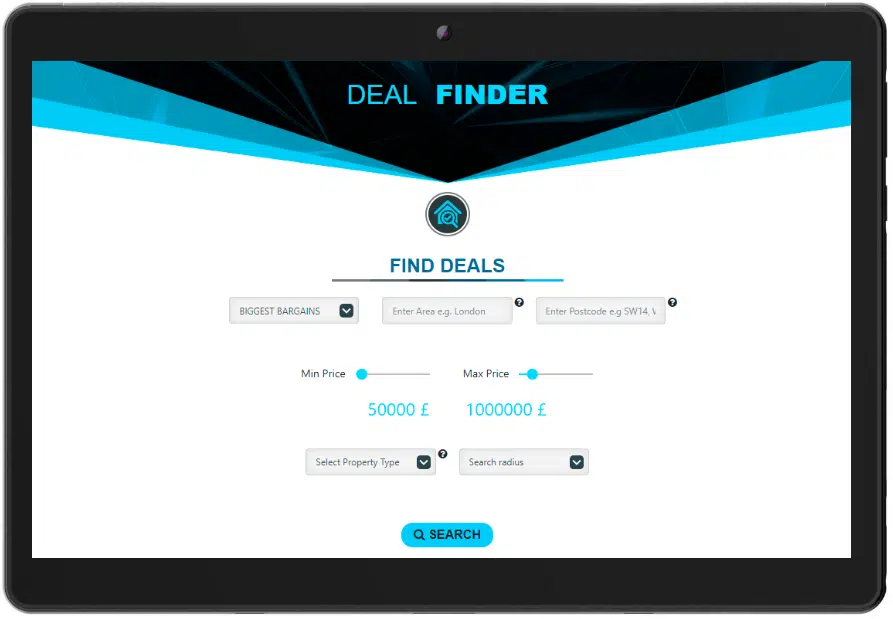

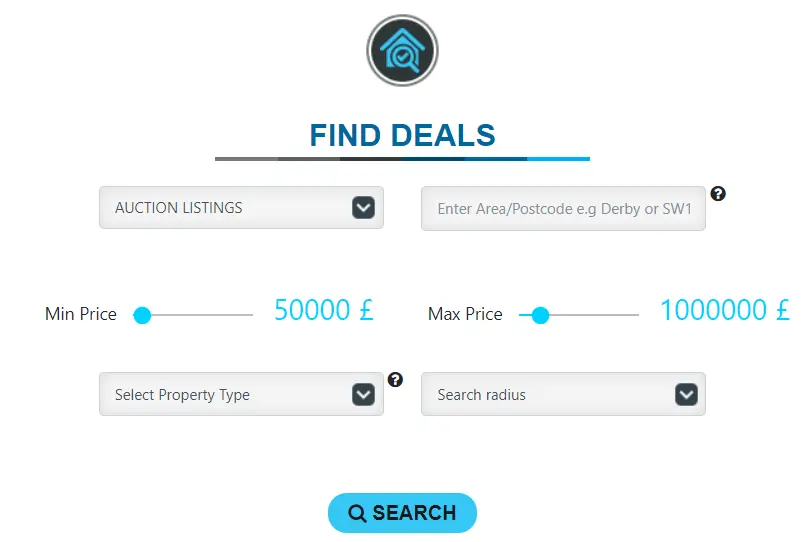

On the dealfinder page, select the short lease option.

For example, let’s have a look at short lease properties in London, SW14

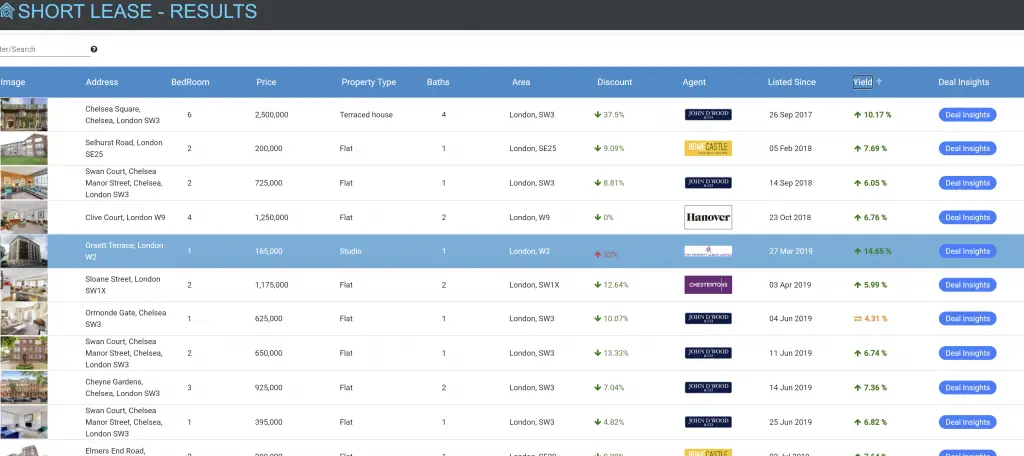

Click search and then property deals will show you all the available short lease properties within that area and let you know not only how much they’re selling for, but how much the price has decreased or increased by, basic details and most importantly; cash flow.

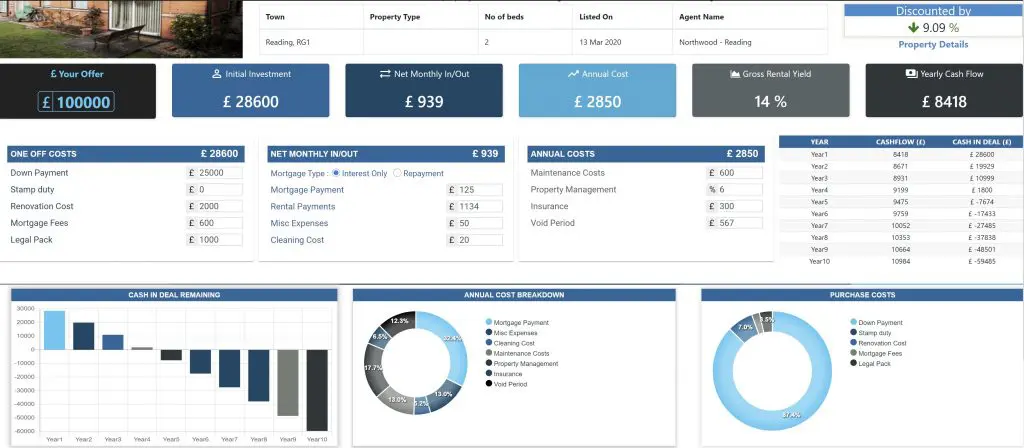

Once you click on Deal Insights, you get a report based on expenditure, renovations, and estimated rent to predict cashflow and revenue for the property.

So if the Deal Insights don’t look great, you won’t waste your time looking into it. Instead, you can look at other properties.

And keep shopping around until you like the look of a cash flow report.

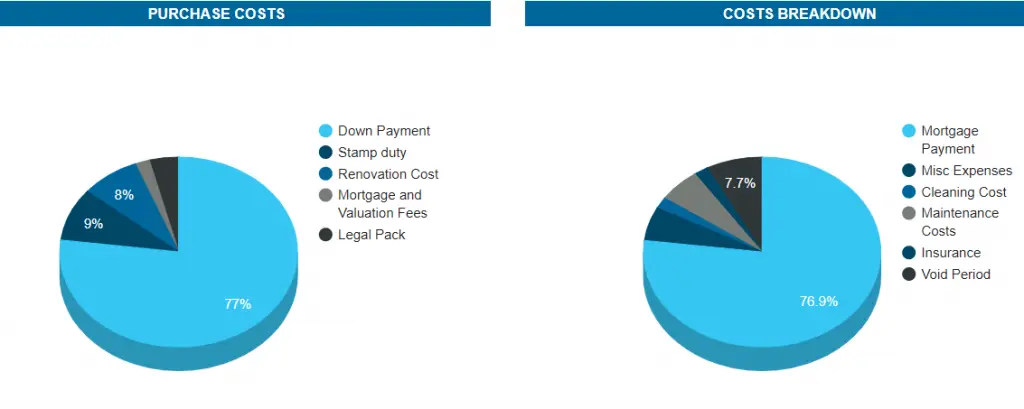

The report is even broken down so you can evaluate all the factors that go into the calculations.

Empowering you to make smart property decisions faster

Try for Free